A tariff is a tax imposed by a government on imported goods, with the goal of increasing the price to make domestic products seem more competitive. Tariffs can be used to protect emerging industries, generate government revenue, or deal with trade imbalances. They usually lead to higher prices for consumers and can provoke retaliatory measures from trading partners.

Recent U.S. Tariff Policy

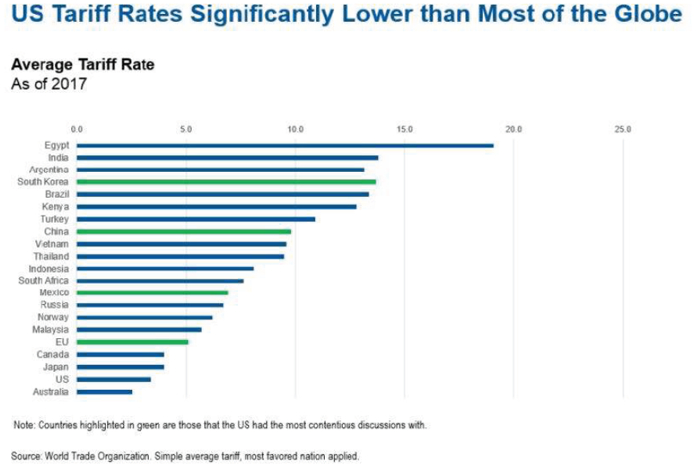

On April 2nd, 2025, the U.S. announced a comprehensive tariff plan. This includes a baseline 10% tariff on all imported goods, with higher rates for specific countries – seen as a ceiling. This was based on the fact that the U.S. has the second lowest tariffs in the world (with only Canada being minutely lower). The U.S. has been dealing with high tariffs from all other countries for many decades, and in some cases, the tariffs imposed on the U.S. were 90+%.

The tariffs aim to reduce the U.S. trade deficit and encourage domestic manufacturing. However, they are meant to be temporary, as the U.S. intends to renegotiate trade with the world one country at a time. In order to get the world’s attention and to force each country to negotiate, the U.S. put blanket tariffs on every country. This has led to some 70+ countries (as of this writing) contacting the U.S. to begin negotiations.

The end goal is to have zero or near-zero tariffs where trade can flow freely. Some argue this could disrupt global trade, increase consumer prices, and potentially lead to a recession if these tariffs take effect and become permanent.

Implications

Consumer:

Tariffs are typically paid by U.S. importers, who may pass these costs onto consumers, absorb them, or a combination of both, leading to higher prices for imported goods.

Business:

Companies that rely on global supply chains might face higher costs, prompting some to adjust their operations. For example, Apple has considered shifting production to countries like India to lessen the impact of Chinese tariffs and control.

Global:

Some countries may retaliate with their own tariffs on U.S. exports, which could escalate into a full-blown trade war.

History

The U.S. Constitution grants Congress the authority to levy taxes, including tariffs. However, Congress has delegated significant tariff powers to the President. This delegation allows the President to impose tariffs without direct congressional approval, especially when justified under national security or other broad criteria. An historic example is the Smoot-Hawley tariff (the Tariff Act of 1930) that took place under President Hoover in 1930 – just after the beginning of the Great Depression.

Main Points

- The Act raised tariffs on over 20,000 imported goods, including agricultural and industrial products.

- The average tariff increased to about 40–60%, making it one of the highest tariff schedules in U.S. history.

Impact

- Immediate retaliation from trading partners, sparking global trade wars.

- U.S. exports plummeted by 60% due to retaliatory tariffs.

- Possibly prolonged the economic downturn of the Great Depression.

If left permanent, economists generally view tariffs as a hindrance to economic growth, as they tend to lead to higher consumer prices. While they can protect specific domestic industries in the short term, the economy may suffer due to increased production costs in the longer run.

See below a chart from 2017 illustrating the comparatively low tariff rates the U.S. imposes versus a handful of global trading partners. Note: Data is from 2017; however, it still reflects the disparity correctly.

As always, if you have any questions, concerns, or comments, please reach out to us!

~ Your SharpePoint Team

*Important Disclosures*

Investment advice offered through SharpePoint, LLC , a Registered Investment Advisor.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market or economic conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Supporting documentation for any claims or statistical information is available upon request.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

Investing involves risk including loss of principal.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.